how long will the child tax credit payments last

Child tax credit payments are coming in days Eligible Americans have been receiving up to 300 per child per month since the payments began in July. The wording surrounding the child tax credit can be a bit misleading.

Child Tax Credit Definition Taxedu Tax Foundation

Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan.

. The package includes a child tax credit. In 2021 the maximum annual credit increased to 3000 per child age six to 17 or 3600 per child age five or younger. The total credit for a child under the age of 6 is 3600 and taxpayers receive 3000 for any other eligible child.

How long will the child tax credit payments last. MILLIONS of families can expect to get the rest of their child tax credit payments from last year in 2022 but theyll need to wait. The Child Tax Credit provides money to support American families helping them make ends meet.

Youll need more than a calculator to keep track of your child tax credit payments. Thus families received up to 1800 for children under the age of 6 and 1500. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

It also established monthly payments which began in. Congress fails to renew the advance Child Tax Credit. By making the Child Tax Credit fully refundable low- income households will be.

This year as part of the American Rescue Plan. The credit amount was increased for 2021. As a result of the American Rescue Act the child tax credit was expanded to 3600 from 2000.

Under the American Rescue Plan families with children aged six and under have received 300 while those with children between six and 17 have received 250. A childs age determines the amount. These payments were part of the American Rescue Plan a 19 trillion dollar.

But others are still pushing for. The American Rescue Plan revamped it for 2021 however. File photo by Mike DoughertyVTDigger.

Theres a possibility that the revamped benefit which has been shown to reduce child poverty could be extended. Families who received monthly payments in the second half of last year can still get up to 1800 for children younger than 6 and 1500. Get your advance payments total and number of qualifying children in your online account.

Enter your information on Schedule 8812 Form. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. The credit was made fully refundable.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. The child tax credit offered this year that is 2021 is based off of your 2020 taxes. I would like to know would I get the additional stimulus credit thats supposed to be for the dependents that I didnt receive.

The Child Tax Credit helps all families succeed. To reconcile advance payments on your 2021 return. Yesterday was September 15 meaning that the third part of the expanded Child Tax Credit went out to.

To be eligible for the maximum credit taxpayers had to have an AGI of. IR-2021-153 July 15 2021. 150000 or less for married couples filing a.

On Friday I submitted a simplified 1040 tax return to claim the 3600 credit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. May 27 2022 545 PM.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000. This impacted tens of millions of families who received up to 300 per child each month from July to December. The credit was increased to 3000 from 2000 with a 600 bonus for kids under the age of 6 for the 2021 tax year.

Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. 75000 or less for singles 112500 or less for heads of household and. Phil Scott signed a tax cut.

For parents of children up to five years old the IRS will pay a total of 3600 half as six monthly payments and half as a. Parents income matters too. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. The child tax credit in general has been available for quite some time but in the past the maximum amount was in the range of 2000. As many families know the Child Tax Credit is not new.

This first batch of advance monthly payments worth. Thursday May 26 2022. In 2020 the maximum annual credit was 2000 per child under age 17.

Phil Scott signed a tax cut package into law on Friday. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

From July to December of 2021 eligible families received up to 300 per child under six years old and 250 for children between the ages of six to 17. And whether it will be extended for future years is very much in question. I also didnt receive the monthly payments that were going out last year.

The American Rescue Plan made a few key changes to the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a 600 bonus.

2021 Child Tax Credit Advanced Payment Option Tas

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

What Families Need To Know About The Ctc In 2022 Clasp

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

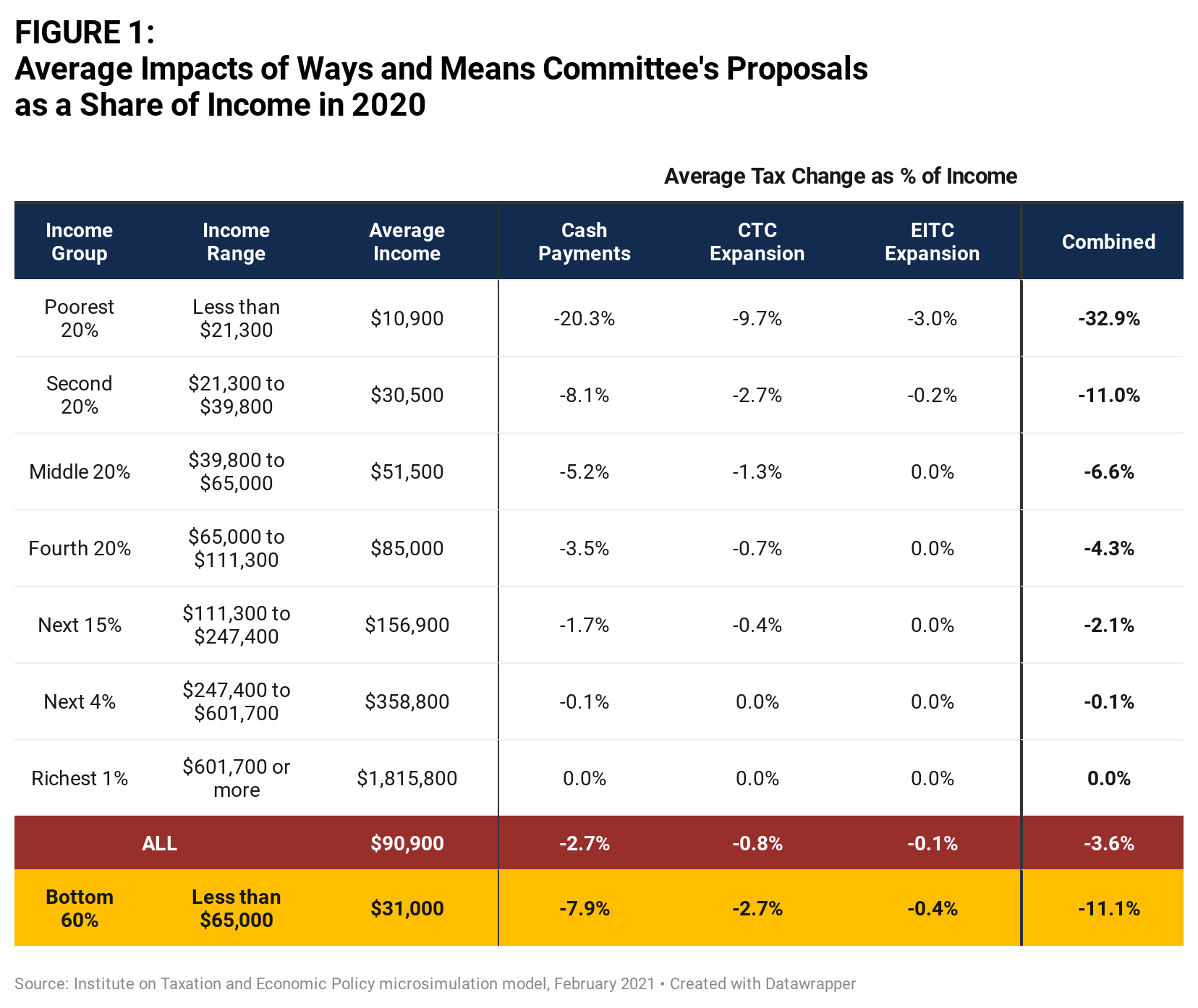

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

The Child Tax Credit Toolkit The White House

Child Tax Credit Definition Taxedu Tax Foundation

How Those Child Tax Credit Checks May Affect Your Tax Refund This Year

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet