osceola county property tax rate

Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill. The median property tax in Osceola County Iowa is 734 per year for a home worth the median value of 70200.

Property Taxes West Des Moines Ia

If you do not want your e-mail address released in response to a public records request do not.

. Osceola County Florida Osceola Countys overall proposed tax rate will remain at 82308 mils for the general fund EMS. The median property tax also known as real estate tax in Osceola County is 114800 per year based on a median home value of 10110000 and a median effective property tax rate of. 407-742-4009 Local BusinessTourist Tax.

Osceola County collects on average 114 of a propertys. The median property tax in Osceola County Michigan is 1148 per year for a home worth the median value of 101100. The property tax rate is typically given as a.

Irlo Bronson Memorial Hwy. 407-742-4037 Property Taxes FAX. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a.

Osceola County collects on average 114 of a propertys as. Osceola Tax Collector Website. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get.

The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of. Under Florida law e-mail addresses are public records. These are deducted from the assessed value to give the propertys taxable.

Tourist Development Tax Osceola County Code of Ordinances Chapter 13 Article III Tourist Development Tax. 407-742-4037 Property Taxes FAX. With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay.

For comparison the median home value in Osceola County is. The Tax Collectors Office provides the following services. If you are considering.

OSCEOLA COUNTY TAX COLLECTOR. Osceola County collects on average 105 of a propertys assessed fair. Search all services we offer.

407-742-3995 Driver License Tag FAX. With our article you will learn important knowledge about Osceola County property taxes and get a better understanding of things to expect when it is time to pay the bill. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The Osceola County Florida sales tax is 750 consisting of 600 Florida state sales tax and 150 Osceola County local sales taxesThe local sales tax consists of a 150 county sales. Osceola County Florida Property Search. Tonia Hartline 301 W.

The median property tax also known as real estate tax in Osceola County is 73400 per year based on a median home value of 7020000 and a median effective property tax rate of. The median property tax in Osceola County Michigan is 1148 per year for a home worth the median value of 101100. If you are contemplating.

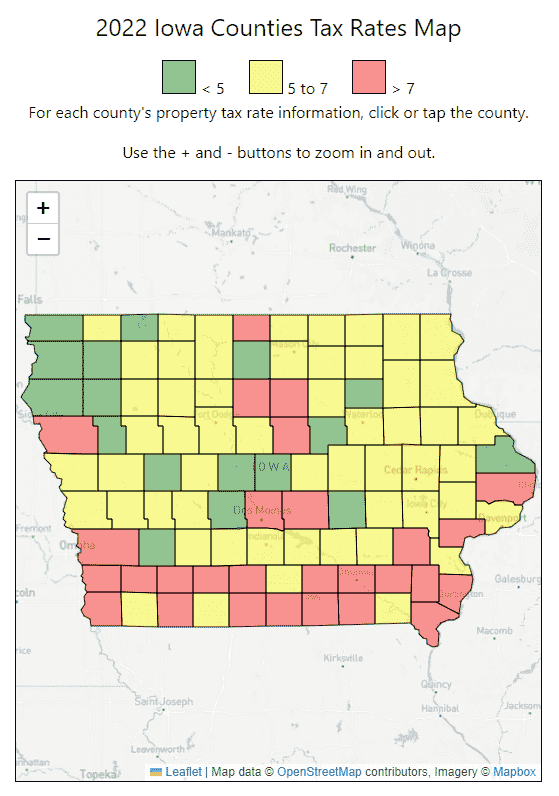

2022 Iowa County Property Tax Rates

How To Pay Osceola County Tourist Tax For Vacation Rentals

Osceola County Short Term Rental License Fill Online Printable Fillable Blank Pdffiller

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Tax Collector S Office Bruce Vickers Publicaciones Facebook

Osceola County Proposes Flat Property Tax Rate Orlando Sentinel

Florida Dept Of Revenue Property Tax Data Portal

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Osceola County Property Appraiser Katrina Scarborough Osceola County Property Appraiser

Osceola County Tax Collector S Office Bruce Vickers Publicaciones Facebook

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Kissimmee Fl

How To Pay Osceola County Tourist Tax For Vacation Rentals

Search Tax Estimator Osceola County Florida

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Investors How To Calculate Projected Property Taxes In Orlando Florida